Last week, we saw Tax Day come and go – uneventfully. Many of you wrote with concerns over the new tax laws and what those mean for you and your investments. For most of you, filing your taxes is a bit robotic every year. It also can become a guilt and shame exercise. Shoe fit?

Actually, tax day (4/15) shouldn’t be the date in your mind to prepare for! You need to calendar October/November as the time to start pondering the best way you can pay yourself more and the IRS less. Didn’t do that? It’s okay!

The Chinese adage about the best day to plant a tree comes to mind. “The best time to plant a tree was 20 years ago. The second best time is now.”

– A Chinese Proverb

Personally, the shame-game caught up with me this year, but from a different place. Let’s just say: a divorce, the sale of a business, and the launch of a consulting platform can do a doozie on a tax return!

But I wasn’t alone. There are many out there feelings “defined” by the math in the blue boxes on their tax returns. But the blue boxes are not who we are. We are the sum total of our relationships, experiences, values, and beliefs – NOT our marginal effective tax rates, or what we did or didn’t do adequately in 2018 to best position ourselves for the future.

The goal for a Perfect Day never changes. I know money is important; I’ve been a financial advisor for 20+ years. So, I would be the last one to dismiss the importance of financial needs and investments. But I would NOT be the first person to say, “When your life stress is on money, you’re going to end up with way too much stress and not enough money!”

The expression, “What you take with you is what you leave behind,” is true.

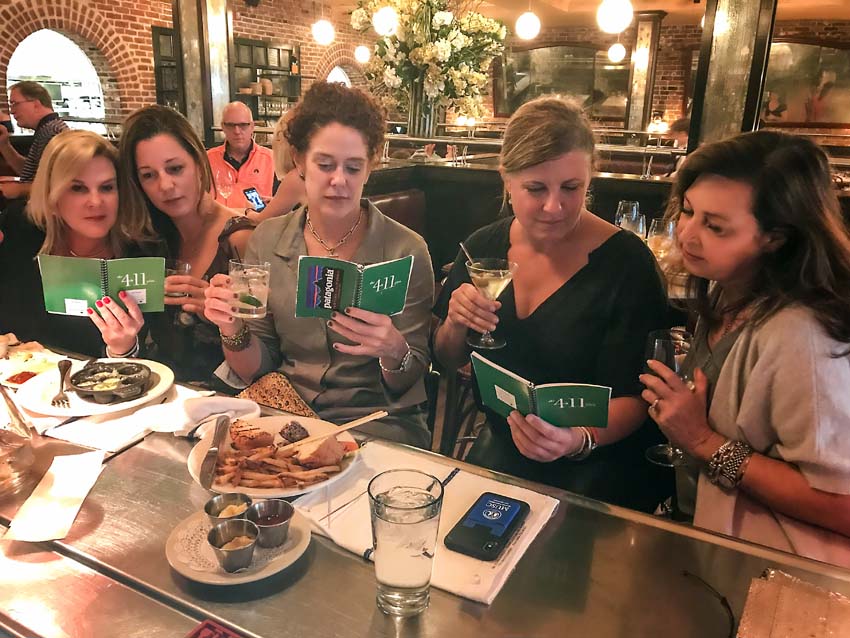

One of my goals with my Perfect Day strategy is to teach you how to lift your head up from your laptop, turn your cell phone off, lay aside your tablet, and think seriously about your epitaph virtues.

What would you like to be remembered for – your chase for more money and material possessions or your desire to have a balance to your life that includes caring, giving, saving, planning, and enjoying the wealth you have achieved?

Always start with the end of your life in mind. When you do, you make life much better, and you will live out your “epitaph focus” each day.

Finally, begin your investment journey, not with a financial spreadsheet or inventory in front of you but with an inventory of gratitude; the things and people and experiences you’re thankful for.

There’s something pretty motivating about being grateful for what you have, and simply wanting to make the most of THOSE things and not necessarily attain new and more things. It prepares you for abundance today, true wealth in the future, and more Perfect Days!

About The Author: Cokie Berenyi

Cokie Berenyi has been in financial services and serving the needs of individual and institutional clients and entrepreneurs since 1996. Mother, author, business owner, financial “samurai” and Perfect Day engineer, Cokie loves food, wine, travel, stray dogs, goat cheese, tennis, and alpine mountaineering.

More posts by Cokie Berenyi